Valuing private SaaS companies can be a fraught and confounding process in which two groups can look at the same numbers and arrive at widely different results. As our long-time readers know, we have sought to provide an objective, data-driven reference point to help overcome the challenges presented by valuing private SaaS companies.

SaaS Capital has been providing debt capital to private B2B SaaS companies since 2007. Over this time, we’ve funded more than 130 firms, which gives us a privileged window of insight into equity raises and M&A transactions. Using our position in the marketplace and the information it provides, we published our first private SaaS valuation framework in 2016.

Over the years, we have refined our methodology to create a stable valuation framework that uses current data from the SaaS Capital Index™, which is updated monthly. This data-driven methodology is based on a statistical analysis of over ten years of data. The result is a downloadable Excel model built on the three primary variables that drive private B2B SaaS valuation:

Since these inputs are dynamic (that is the specific values can be updated with the latest available data), the model can be used at any time and across market regimes to help establish a foundation for valuing private B2B SaaS companies.

The latest white paper from SaaS Capital on valuing private SaaS companies can be found here – What’s Your SaaS Company Worth?

Public market valuations are a natural starting point for developing a private company valuation methodology. They reflect the summation of countless participants transacting on real-time information. Moreover, they have high data integrity as they cover a broad sample size of different companies and are based on audited financial results.

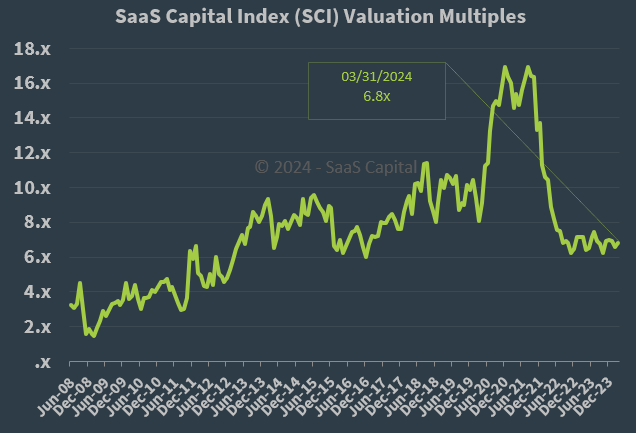

We developed the SaaS Capital Index to capture what we feel is the best composite of the public company B2B SaaS universe and serve as a near real-time snapshot for the valuation multiple assigned to public SaaS companies. As a reminder, with software-as-a-subscription (SaaS) companies, we use revenue multiples to describe their valuations, rather than earnings multiples like in traditional price-to-earnings multiple. This is for two main reasons:

As of March 31, 2024, the SCI median valuation multiple stands at 6.8 times current run-rate annualized revenue (we believe run-rate revenue is the most accurate measure of the current scale of the business). While the multiple has stabilized in the 6-7x range, it is down roughly 60% from its peak achieved in 2021.

The median valuation multiple is now at levels last seen in the 2015-2016 period. However, there are important differences between the current multiple and those of 8-9 years ago. Most significantly, the current valuation multiple is supporting a very different balance between growth rate and profitability for the median company. [See our recent research: Why Long-Term SaaS Revenue Growth Rates are Slowing; and What it Means for Your Private B2B SaaS Company].

ARR growth rate is a critical metric for companies and the primary variable impacting changes in private company valuations in our model. We calculate it by annualizing realized trailing revenue growth figures. It should not be based on forecasts.

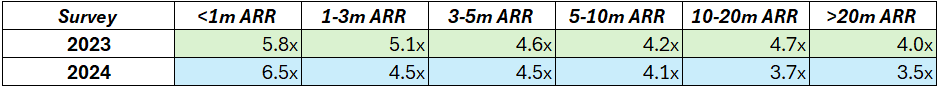

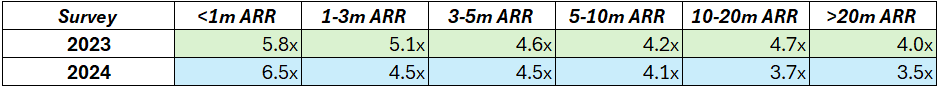

SaaS Capital recently completed its 2024 survey of private, B2B SaaS companies. Based on the most recent survey (see table below), revenue growth rates, in general, have moderated from the highs seen in the 2022 survey; however, when measured from their levels in the 2021 survey, private SaaS companies have continued to experience expanding growth rates or, for the larger private companies, smaller declines in growth rates compared to the public SaaS companies in the SCI.